Understanding Money 101

An investment in knowledge pays the best interest. -Benjamin Franklin

Websites

Links

A Primer on Money (1964) explains in simple, everyday language how our monetary system works and indicates where it needs reform. This is a Congressional Subcommittee Report authored by Congressman Wright Patman.

Money Facts (1964) 169 Questions and Answers on Money -- A Supplement to "A Primer on Money."

"Money Facts" is a series of questions and answers on the basic workings of our monetary system.

Benjamin Franklin and the Birth of a Paper Money Economy

by Farley Grubb

"Benjamin Franklin's life spans most of the first epoch of paper money, and he is its most insightful analyst and ardent defender."

Books

Web of Debt: The Shocking Truth About Our Money System and How We Can Break Free

by Ellen Hodgson Brown

The most important current book one can read on understanding the current economic crisis and its solution.

The Babylonian Woe

by David Astle

A study of the Origin of Certain Banking Practices and of their

effect on the events of Ancient History written in the light of the

Present Day.

The Lost Science of Money

by Stephen Zarlenga

A modern classic on money. "The Mythology of Money: The Story of Power"

Fixing the System: A History of Populism, Ancient and Modern

by Adrian Kuzminski

A New Monetary System

by Edward Kellogg

The Role of Money: What It Should Be, Contrasted with What It Has Become

by Frederick Soddy

Direct Credits for Everybody: Showing How Capitalism Will Work

by Alfred Lawson

Tragedy and Hope: A History of the World in Our Time

by Carroll Quigley

Lorem ipsum his ut explicari vituperata adversarium, semper commune mediocrem eos ex. Vim solet consul vocibus ei. Facer fuisset officiis vel ex, at vix partem tractatos, habeo maluisset id mei. Ad duo sale munere facete. Ex vidit brute feugiat qui, mei ullum zzril aliquam id, est ei tollit munere persecuti. Ius cu gloriatur constituto neglegentur, quem scripta vulputate ne quo, qui in quem accumsan. Ad nominati sententiae usu, sit te commodo minimum.

Selected Articles

The Money Myth Exploded

by Luis Even.

One of the most popular articles to explain how money is created as debt by private banks.

Understanding Money by John H. Hotson.

"...is essential for those seeking economic reforms toward the creation of sustainable societies..."

Tragedy and Hope – An Introduction

By Michael L. Chadwick

"...one of the most revealing books ever published..."

Money and Liberty

by Adrian Kuzminski

"...It is essential to this end to understand how a non-usurous, publically

accountable currency might work."

Margrit Kennedy Inspires NZ Groups to Establish Regional Money Systems

by Deidre Kent.

According to a German study, interest composes 30 percent to 50 percent of everything we buy.

More....

Links on Fractional Reserve Lending

How Banks Make Money: Creating Money Out of Thin Air

by Doug Pibel.

Very illustrative.

US Banks Operating Without Reserve Requirements

by Eric deCarbonnel.

"...reserve requirements falling to zero over the last fifty years..."

Reserve Requirements: History, Current Practice, and Potential Reffrom

By Joshua N. Feinman.

From the Federal Reserve itself.

Reserve Requirements for Various Countries (.xls)

Videos

Banking 1

Banking 2: A bank's income statement

Banking 3: Fractional Reserve Banking

Zeitgest: The Movie

Zeitgest: Addendum

More...

Introduction

The purpose of this website is to provide a library of resources for a true understanding of money and our current monetary system.

In our current monetary system, all our money is created by private banks by means of debt. Monetary reform, taking back the authority to create money, from private banks to the government, is the central issue that unites and resolves all others, since our current privatized monetary system is the core of the elite's power base, and the reason for poverty and war, etc.

Henry Ford (1863-1947), the American industrialist and pioneer of the assembly-line production method, stated:

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Why is understanding money important?

Money is the oil that makes the machine of society function. Who creates it and who controls it controls the fate of society. To understand money is to understand how our society is controlled and by whom.

Further, an understanding of money is necessary for a society to take back and retain control of its monetary system for the good of the people.

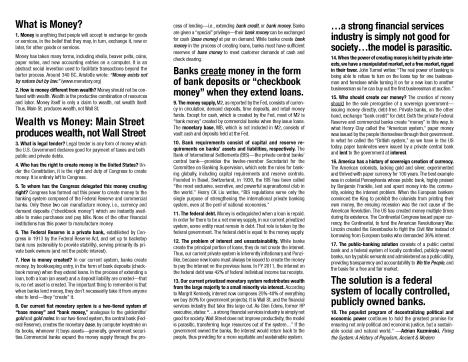

A Flyer on Money & Banking 101

A tri-fold flyer, from the Public Banking Institute (PBI), explaining money and banking is here: Reclaim the MONEY POWER with Publicly Owned Banks: OCCUPY BANKS.

If you want to just the cover image.

Introduction

What is MONEY?

Money is simply a medium of exchange for goods and services. Further, "money is an abstract social invention that serves the purpose of advancing commerce and trade beyond the barter process," writes Jere Hough.

MONEY vs. WEALTH

Money should not be confused with wealth. As Jere Hough writes, “All wealth is a combination of resources and labor.” In “Fixing the System: A history of populism, ancient and modern,” Kuzmiski writes, “Money and wealth are mutually exclusive: money itself being only a claim to wealth, and not that wealth itself.”

THE CREATION OF MONEY & CREDIT IS THE SOLE PREROGATIVE OF A SOVEREIGN GOVERNMENT

Most people are exposed to thinking that banking is, and should be, a private undertaking, as with most businesses. The problem is that people are misled in their understanding of how banking really works. A true understanding of money and banking will lead people to correctly see that a significant activity of banking, the extension of credit, is truly a public function.

1. In our current system, banks create money.

Private banks today, including the Federal Reserve, do not lend money they have on deposit, nor borrow money at a low interest and loan it out at a higher interest rate. Private banks today, through fractional reserve lending, create money--money that is backed by the “full faith and credit of the United States”--out of thin air by bookkeeping entry, whenever anyone, including the government, takes out a loan. As Ellen Brown states in “Web of Debt”: “They merely ‘monetize’ the borrower’s promise to repay.” Believe it. References to this fact abound, even from the Federal Reserve itself. One example, "Modern Money Mechanics," no longer in print but available on the internet, by the Federal Reserve bank of Chicago, describes “the basic process of money creation in a ‘fractional reserve’ banking system." The well-referenced article, "DOLLAR DECEPTION: HOW BANKS SECRETLY CREATE MONEY," by Ellen Hodgson Brown, is another good source ().

However, one should note that the credit extended by private banks is not theirs to extend but instead is an asset of the community – afterall, it is currency backed by the “full faith of the United States.” Thus the extension of credit, in US currency, by a private bank can be considered a fraud, while a public bank creating US currency would not.

2. Money is simply a medium of exchange for goods and services and should be fiat by law.

“Money is an abstract social invention that serves the purpose of advancing commerce and trade beyond the barter process,” writes Jere Hough. Money can be viewed simply as a means to facilitate transactions—in other words, money can be viewed as a contract, a financial obligation. The contractual nature of money is illustrated by the fact that, while tangible currency (coins and dollar bills) make up less than 3 percent of the US money supply, the other 97 percent exists only as data entries on computer screens (from “Web of Debt,” by Ellen Hodgson Brown).

Money should not be confused with wealth. As Jere Hough writes, “All wealth is a combination of resources and labor.” In “Fixing the System: A history of populism, ancient and modern,” Kuzminski writes, “Money and wealth are mutually exclusive: money itself being only a claim to wealth, and not that wealth itself.”

Zarlenga writes (at monetary.org) that “both Aristotle and Plato noted the paramount principle - that the nature of money is a fiat of the law, an invention or creation of mankind.” Around 340 BC, Aristotle wrote: "Money exists not by nature but by law.”

Money based on a commodity, such as gold or silver, on the other hand, has several disadvantages: A limited supply needlessly inhibits the exchange of goods and services, large holders of the commodity can have a manipulating and unfair advantage, and a commodity-based system is unworkable in practice. The impracticalities of a gold standard are explained by Ellen Brown in her interview with the Daily Bell, where one major point is the following: Where would the gold come from to exchange our dollars with?

And, Stephen Zarlenga, author of “The Lost Science of Money,” writes, “History shows the so-called gold standard has been a shell game and a ruse and a tool of plutocracy,” where, historically, there has always been more gold-backed notes than the gold to back them [Ref].

3. The authority to create money should be the sole prerogative of a sovereign government.

A country’s control of its own money supply is tantamount to control of its own destiny. This point is inversely made by Nathan Rothschild, of the Rothschild family private banking dynasty, boasting in 1838, “Let me issue and control a nation’s money and I care not who writes its laws.”

While most may believe that the American Revolution was about “taxation without representation,” Brown explains, in “Web of Debt,” that the real issue was the colonists desired to create their own money rather than borrow it from British bankers. Brown writes: “The colonists’ new paper money financed a period of prosperity that was considered remarkable for isolated colonies lacking their own silver and gold.” In fact, a highly successful public bank of colonial Pennsylvania, highly praised by Benjamin Franklin, lent and and spent money “into the economy, covering the interest shortfall and keeping the money supply in balance,” according to Brown. In addition, “the public land bank collected interest and returned it to the provincial government to be used in place of taxes.”

After a century of prosperity in the colonies, the British bankers convinced the king to forbid the printing of money by the colonists. Brown quotes Benjamin Franklin as stating the real reason for the Revolution: “The colonies would gladly have borne the little tax on tea and other matters had it not been that England took away from the colonies their money, which created unemployment and dissatisfaction.”

4. In conclusion, public banking is needed for a just and sustainable system.

When money and banking are understood properly, it is clear that the extension of credit, a primary function of a bank, is a public function. While people may express concern about the government in the banking business, it should be noted that a publicly owned bank is answerable to the people, while a private one is not.

With respect to the claim for unfair competition by the government, note that the “free market” must exist with a means for the exchange of goods and services: a community-defined, or government fiat, currency. This currency is not to be confused with wealth – it is merely a means to facilitate transactions. The free market becomes a manipulated market when the currency is created by private interests, where the authority to create money in private hands leads to preferential access to credit as well as a transfer of wealth, in the form of interest payments, from the people to the private bankers.

In response to charges that public banking is “socialism,” Farid Khavari, Florida gubernatorial candidate, responded: "Are public schools socialism? Public roads, police and fire protection, municipal water? Socialism is where everyone works for the state. In these cases, and with our Bank of the State of Florida, the state is working for everyone.”

Center Content

Lorem ipsum his ut explicari vituperata adversarium,

semper commune mediocrem eos ex. Vim solet consul vocibus ei. Facer fuisset

officiis vel ex, at vix partem tractatos, habeo maluisset

id mei. Ad duo sale munere facete. Ex vidit brute feugiat qui, mei ullum

zzril aliquam id, est ei tollit munere persecuti. Ius cu gloriatur constituto

neglegentur, quem scripta vulputate ne quo, qui in quem accumsan. Ad nominati

sententiae usu, sit te commodo minimum. Lorem ipsum his ut

explicari vituperata adversarium, semper commune mediocrem eos ex. Vim

solet consul vocibus ei. Facer fuisset officiis vel ex, at vix partem tractatos,

habeo maluisset id mei. Ad duo sale munere facete. Ex vidit brute

feugiat qui, mei ullum zzril aliquam id, est ei tollit munere persecuti. Ius

cu gloriatur constituto neglegentur, quem scripta vulputate ne quo, qui in

quem accumsan. Ad nominati sententiae usu, sit te commodo minimum.

Lorem ipsum his ut explicari vituperata adversarium,

semper commune mediocrem eos ex. Vim solet consul vocibus ei. Facer fuisset

officiis vel ex, at vix partem tractatos, habeo maluisset

id mei. Ad duo sale munere facete. Ex vidit brute feugiat qui, mei ullum

zzril aliquam id, est ei tollit munere persecuti. Ius cu gloriatur constituto

neglegentur, quem scripta vulputate ne quo, qui in quem accumsan. Ad nominati

sententiae usu, sit te commodo minimum. Lorem ipsum his ut

explicari vituperata adversarium, semper commune mediocrem eos ex. Vim

solet consul vocibus ei. Facer fuisset officiis vel ex, at vix partem tractatos,

habeo maluisset id mei. Ad duo sale munere facete. Ex vidit brute

feugiat qui, mei ullum zzril aliquam id, est ei tollit munere persecuti. Ius

cu gloriatur constituto neglegentur, quem scripta vulputate ne quo, qui in

quem accumsan. Ad nominati sententiae usu, sit te commodo minimum.